BUSINESS BROKER - MANUFACTURING SPECIALISTS.

(A) 76 METHODS

MACHINERY APPRAISALS

(B) R.O.I.

RETURN ON INVESTMENT

(C) STOCK

VALUATIONS AND APPRAISALS

(D) NEED TO KNOW

QUESTIONS OWNERS NEED TO KNOW THE ANSWERS TO

(E) BUSINESS ANALYSIS

TO BUY OR SELL A BUSINESS

(A)

PLANT AND MACHINERY

76 METHODS OF APPRAISING PRICES FOR PLANT AND MACHINERY

|

There is an infinite variety of machinery and plant, some becomes unusable

quickly while others last 50 years or more. The rate of obsolescence (obsolescence

is subject to profitable use), quality of maintenance, length of use (wear

and tear), universal or specialised use, all create many variables even

for individual identical items. To all this the Tax Department adds just

a few percentage rates for calculating depreciation, so that based on averages,

your plant and machinery replacement costs are not taxed over a period

of time.

Jim Travers was directly involved in major machinery Auctions and has

sold privately over 5000 items of machinery as well as many thousands of

small items - so after all that experience you might ask "So how do you

value plant and machinery in a business?"

Well here are seventy six different ways (there may be more). Remember

- inflation and repayment of depreciation tax must be kept in mind. Items

are valued with Singularly or as an Industry such as a group of machines

to make a component or product.

VALUATION CHOICES

1. Plant at depreciated value in accounts.

2. Scrap price.

3. Plant sold at Auction in situ.

4. Plant sold at Auction shifted but on your premises.

5. Plant sold at Auctioneer's premises.

|

VALUATION CHOICES

|

SELLING TO USER

SINGLE ITEM

|

SELLING TO USER

AS AN INDUSTRY

|

SELLING TO DEALER

SINGLE ITEM

|

SELLING TO DEALER

AS AN INDUSTRY

|

|

NUMBERS 6 TO 69

|

CURRENT

|

OBSOLETE

|

CURRENT

|

OBSOLETE

|

CURRENT

|

OBSOLETE

|

CURRENT

|

OBSOLETE

|

|

OPERATIONAL:

Dirty

Condition:

Clean

Condition:

Repainted

Condition:

Exposed

to Weather:

|

6

7

8

9

|

10

11

12

13

|

14

15

16

17

|

18

19

20

21

|

22

23

24

25

|

26

27

28

29

|

30

31

32

33

|

34

35

36

37

|

|

NON-OPERATIONAL

Dirty

Condition:

Clean

Condition:

Repainted

Condition:

Exposed

to Weather:

|

38

39

40

41

|

42

43

44

45

|

46

47

48

49

|

50

51

52

53

|

54

55

56

57

|

58

59

60

61

|

62

63

64

65

|

66

67

68

69

|

70. Ongoing concern basis (generally means some goodwill is

included).

71. Replacement cost as a going concern

72. Existing use value.

73. ESTIMATED REALISABLE VALUE

Fire sale by lot AUCTION/TENDER

Reliant on Auctioneer (Salesperson) knowing the Product.

74. FAIR MARKET VALUE

Sale Price of a single used machine from a MERCHANT/END-USER to another

willing purchaser who has an immediate use for the item.

Generally on pallet at workshop - store door.

75. EXISTING USE (in situ) VALUE

Our assessment of a producing machine INSTALLED, levelled with SERVICES

power, air hydraulics, gas, steam, water, etc.

AND complimented by other Machinery to create an industry.

Note: A single machine does not constitute an industry.

76. REINSTATEMENT VALUE

Insurance claim following a disaster.

A new machine of a similar capacity as that destroyed and including,

special footings, crane hire, installation costs and connecting services,

etc.

The essential step is to get an independent Machinery Appraiser's written

opinion as your own estimate will not usually be accepted by Purchasers.

(B)

RETURN ON INVESTMENT (R.O.I.) WHAT DOES IT MEAN?

|

According to the dictionary:-

-

Return means to yield a profit, profit is a gain, benefit or advantage,

-

Gross profit is the receipts less immediate costs of production.

-

Nett profit is the amount remaining after deducting ALL COSTS from

gross receipts.

Investment of money or capital is required in order to secure profitable

returns or interest.

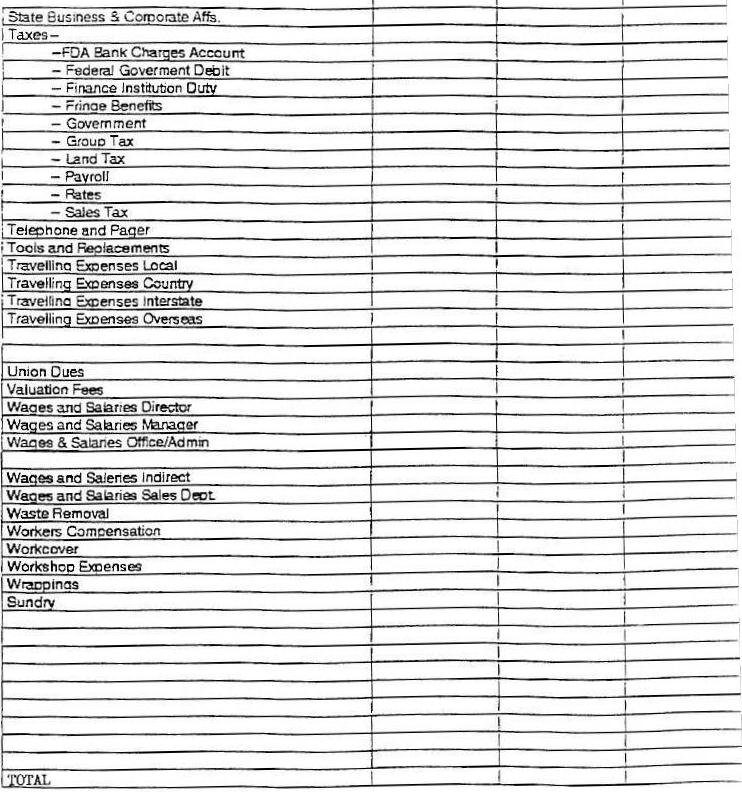

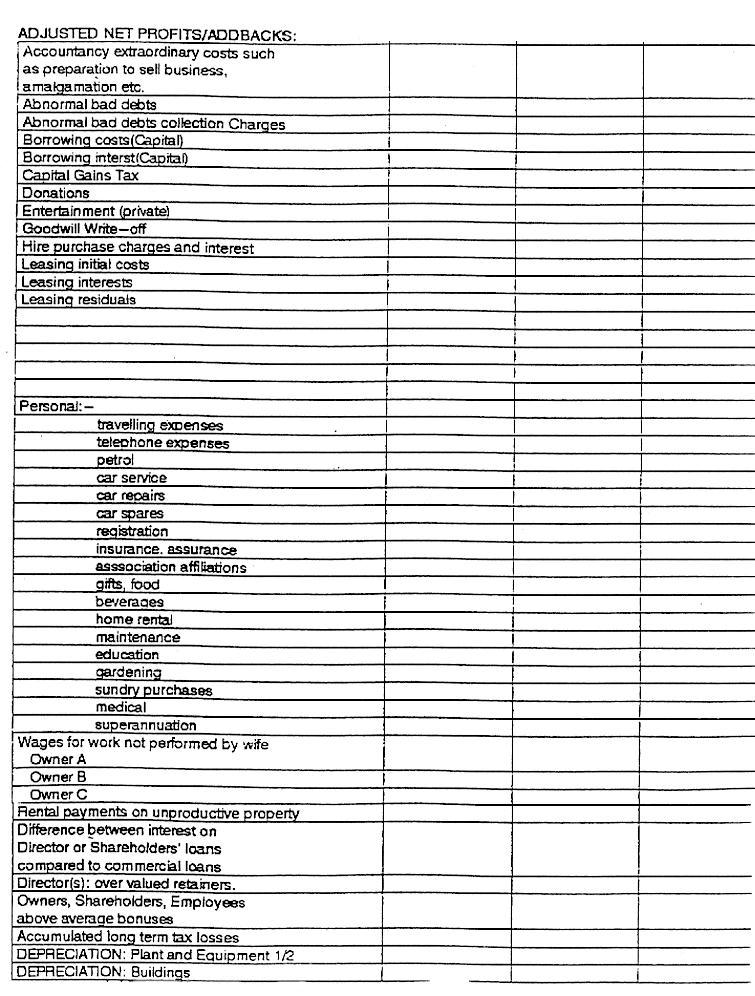

ADJUSTED NETT PROFITS;

The following list of profit add backs (plus others) are added to the

nett profit in your Profit and Loss Statement.

ADDBACKS: to be considered to arrive at the business' actual

profit.

There are undisputed add back items agreed by both Vendors and Purchasers,

however, other items such as plant depreciation and leasing amortisation

because they are such indecisive items are not included in the list below.

-

Accountancy extraordinary costs such as preparation to sell business,

amalgmations, etc.

-

Abnormal bad debts.

-

Abnormal bad debt collection charges.

-

Borrowing costs (for capital purchases).

-

Borrowing interest (for capital purchases).

-

Donations.

-

Entertainment (private)

-

Hire purchase charges and interest.

-

Leasing initial costs.

-

Leasing interests.

-

Leasing residuals.

-

Personal:

-

- Travelling expenses - gifts, food

-

- Telephone expenses - beverages

-

- Petrol - home rental

-

- Car service - maintenance

-

- Car spares - education

-

- Registration - sundry purchases

-

- Insurance, assurance - medical

-

- Association affiliations - superannuation

-

Wages for work not performed by wife:-

-

- Owner A

-

- Owner B

-

- Owner C

-

Rental payments on unproductive property.

-

Difference between interest on Director or Shareholders' loans compared

to commercial loans.

-

Director(s): over valued retainers.

-

Owners, Shareholders, Employees above average bonuses.

-

Accumulated long term tax losses.

(C)

STOCK VALUATIONS AND APPRAISALS

|

Stock valuations are a good idea, although in many kinds of businesses

Vendors and Purchasers come to agreement without independent stock valuations.

Stock is normally subject to valuation at settlement time and in a manufacturing

business it is divided into three parts:-

-

Raw material

-

Work in progress

-

Finished stock

a) RAW MATERIAL

Stock values of raw material.

The lower of market value or delivered cost.

b) WORK IN PROGRESS

Material cost plus labour added plus indirect costs.

However, there can be many factors affecting this such as:

1. Extended time to convert work in progress

to sales.

2. Incomplete stock can be worth scrap value to

you where it cannot be competitively completed.

3. Tariff or Government subsidy, suddenly removed

allows imported products to enter the market at a lower price than it costs

for you to complete existing work in progress.

4. Order cancelled.

5. Where product is specifically designed for the

one customer who is unable to continue trading with you.

6. The loss of key personnel or machinery.

These are problem areas where partially written off work in progress can

amount to a considerable figure and often requires the use of an independent

arbitrator to appraise that stock.

c) FINISHED STOCK

Same basis of valuation for the business as in previous years approved

by your accountant and Taxation Department.

Which is usually the lower of either cost or market value.

(D)

QUESTIONS OWNERS NEED TO KNOW THE ANSWERS TO ...

|

1. "My business has enormous potential".

How much more is it worth?

Excellent, potential will help to sell it. Most owners expect to receive

a large sum of money for potential. The truth is it can induce Purchasers

to buy a business, however, they are not prepared to pay premium for potential

as they expect the money made will be kept entirely for themselves.

2. Goodwill

What is it?

We can appraise your business and specialise in great detail in the

area of GOODWILL, an area interpreted often very wrongly by some professional

people who should take the trouble to find out instead of guessing.

3. Return on Investment:

What does it mean?

Most people assume when comparing return on investment of various businesses

that they are on the same defined basis. This is not so. "Purchaser Beware".

Ask for the definition in detail relating to the business you are analysing.

4. Harsh Reality:

What ever you believe your business is worth, unless it can be justified,

rarely will anyone in the real commercial world pay what you ask.

5. Sell Out:

Sell Out!!! It goes against the grain.

(E)

TO BUY OR SELL A BUSINESS ...

BUSINESS ANALYSIS ...

|

TO BUY OR SELL A BUSINESS

Appraisal Extracts from BUSINESS BROKER REVIEW Author J. Travers

R.O.I. PLANT - STOCK - GOODWILL - PROPERTY - WORKING CAPITAL

Business Analysis presentation (Due Diligence) Copyright

Travers and Cobiac 1991.

BUSINESS ANALYSIS

The presentation of your profit and loss statement fulfils the

obligation of Corporate law and tax returns but does not demonstrate the

business value.

FILL OUT INFORMATION FILE BELOW

For 3 years trading of all income and expenses list adjusted net

profit add backs.

Depreciation of machinery and plant.

Depreciation of buildings

Monthly income

Net sales.